Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing! Welcome to WordPress. This is

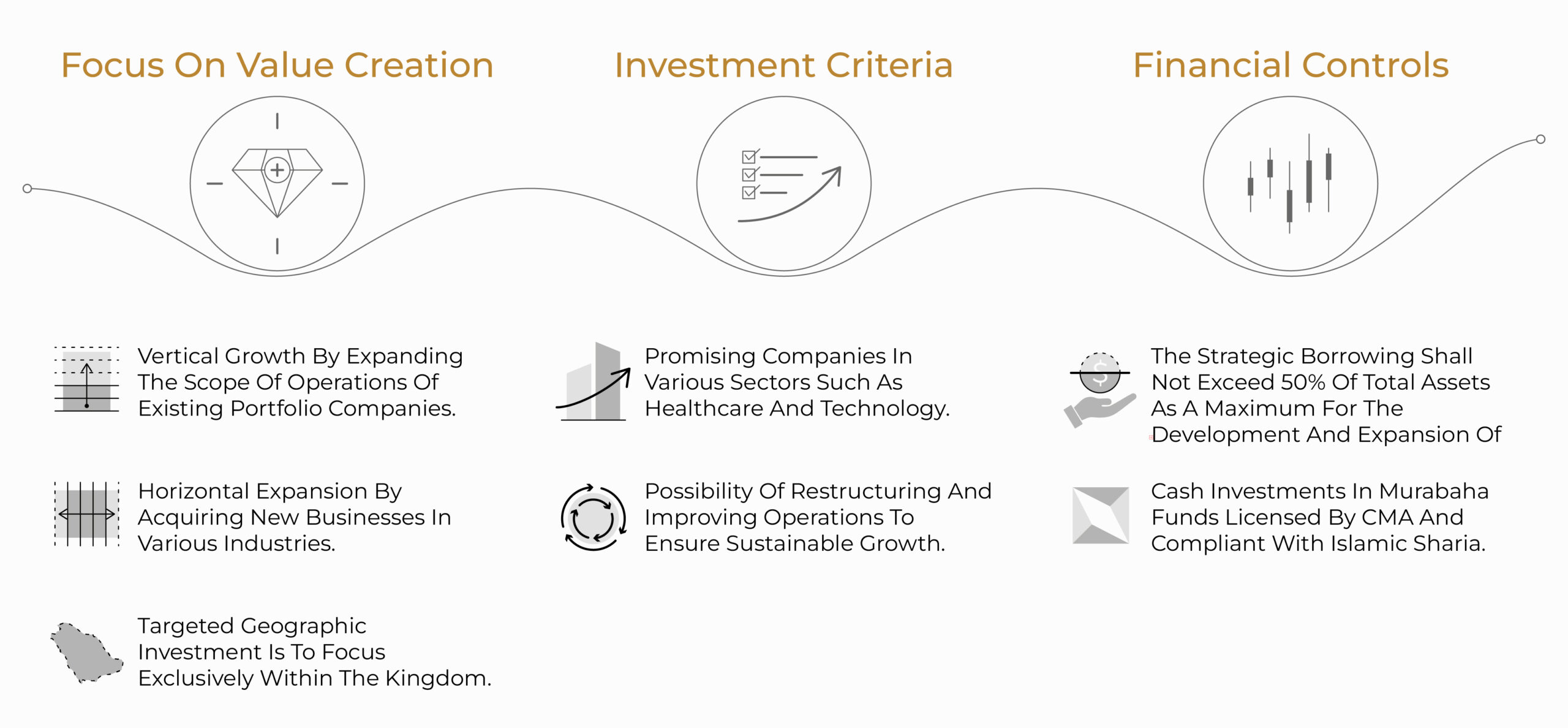

It is a closed-ended It is established in accordance with the laws and regulations in force in the Kingdom of Saudi Arabia and subject to the supervision and oversight of the Capital Market Authority “CMA”. The fund relies on strategic investments to achieve capital growth in the medium and long term by acquiring controlling interests or minority shares in promising companies and various sectors.

Jana Private Fund aims to achieve capital growth in the medium and long term by acquiring controlling interests or minority shares in companies operating in several diverse sectors, most notably the medical sector, and making administrative and operational changes and improvements that will increase the value of those companies, and therefore contribute to restructuring companies and exiting through offering the company for public subscription or direct listing or selling interests to investors.

The Fund is licensed by the Saudi CMA under No. (SPE00827) and is compatible with the principles of Islamic Sharia.

To achieve economic growth through structured investments, strategic management and operational excellence

Meeting the expansion of the Fund's current subsidiaries

Acquiring diverse companies and sectors.

Obtaining financing to meet the needs, expansion and growth of the Fund.

Offering the Fund’s units for public subscription.

The Fund is supervised by an experienced and efficient board of directors:

Chairman of the Board of Directors

Chairman of the Board of Directors

Chairman of the Board of Directors

Chairman of the Board of Directors

The Fund achieves fixed returns ranging between 10% and 15% annually, as it seeks to access exclusive growth opportunities in the dynamic economy of the Kingdom, and to benefit from a distinguished management rich in leading financial experts with a proven track record of success.

The minimum subscription is 100,000 Saudi riyals. Options for subscription to the Fund include a cash or in-kind subscription only in exchange for the sale or transfer of assets or shares in existing companies.

An exit mechanism is implemented to achieve the maximum benefit for the Fund to enhance the returns of unitholders by selling part or all of the assets of the Fund’s portfolio to strategic investors or several interested investors or a public offering for subscription or direct listing on the capital market.

Acquisition Phase: Targeting and purchasing strategic equity shares.

Restructuring Phase: Implementing operational and financial improvements.

Exit Phase: Implementing exit operations at the appropriate time and distributing returns to investors.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing! Welcome to WordPress. This is

Welcome to WordPress. This is your first post. Edit or delete it, then start writing! Welcome to WordPress. This is

Welcome to WordPress. This is your first post. Edit or delete it, then start writing! Welcome to WordPress. This is